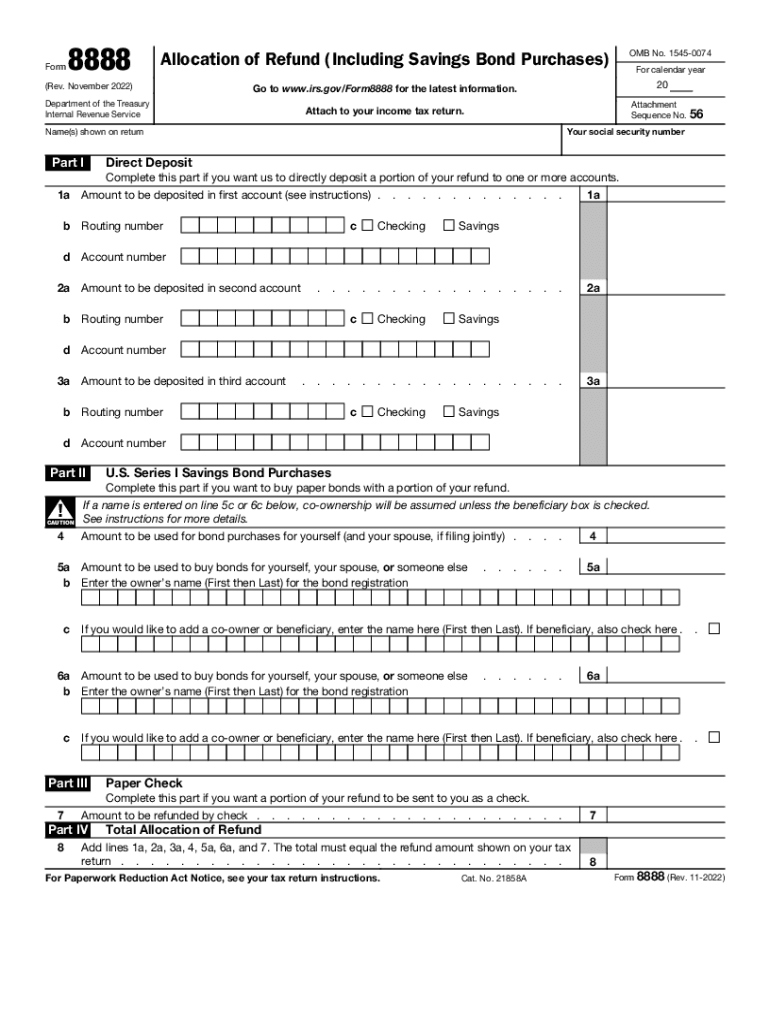

What is Form 8888?

Tax Form 8888 is filed as a claim for Allocation of Refund (Including Savings Bond Purchases). Taxpayers utilize this document to directly deposit their refund to their accounts in banks or other financial organizations in the US or buy up to five thousand dollars in paper Series I Savings Bonds using their rebate.

Who should file IRS Form 8888 2023?

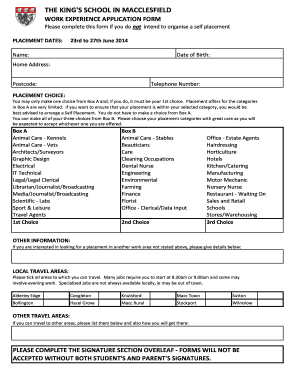

Allocation of Refund must be filed by people who:

- Want the Internal Revenue Service to directly deposit a rebate to an account in one of the United States financial institutions

- Want to buy up to $5,000 in paper or electronic Series I Savings Bonds for their rebate or its portion

What information do I need to file Form 8888?

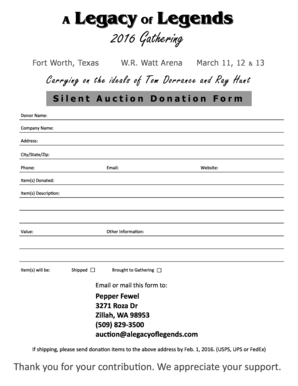

The sample requires filers to indicate their name (as shown on the filed return) and Social Security Number. Filers will also need to decide if they want their reimbursement to be sent as a check to the direct deposit or used to buy savings bonds.

How do I Fill out Form 8888 in 2024?

The entire template consists of four pages. However, filers only need to fill out the first page. On the other three pages, they can find instructions on filing the Allocation for Refund. The one-page sample is easy-to-complete. Follow the recommendation below to prepare the document properly with pdfFiller:

- Select Get Form to open the fillable template in a specialized online filler.

- Click the fillable fields to insert your name and SSN.

- Fill out Part I if you want the IRS to deposit your reimbursement to up to three accounts.

- Fill out Part II to use the rebate for buying savings bonds.

- Fill out Part III to request the IRS send your rebate as a check.

- Indicate the total allocation of the refund in Part IV.

- Double-check the sums in the document. Make sure the total allocation matches the amount on your tax return.

- Click Done to close the filler and access the exporting menu.

- Get your document prepared and downloaded, sent, or printed in just a few clicks.

Is Form 8888 (IRS) Accompanied by any Other Documents?

Allocation of Refund must be attached to the US Individual Tax Return (1040 or equivalent).

When is IRS 8888 Form Due?

Because of the requirement to attach the document to the tax return, the deadline coincides with form 1040’s due date. All taxpayers must submit their income report by the fifteenth day of the fourth month following the end of the calendar year. Typically, the tax day falls on April 15th or is postponed to the following business day.

Where do I send the completed Form 8888?

Since the template must be attached to the Federal Income Tax Return, the destination of this document is also the local IRS office.